Students seeking style and affordability, discover how Mini Cooper's Oxford Edition and Hardtop 2 Door might just be your perfect match

Discover why a manual transmission Mini Cooper enhances your driving experience, offering control and connection lost in automatic models—find out how.

Keep your drive eco-friendly and exciting with the 2023 Mini Cooper Electric; discover how it transforms your commute and conserves the environment.

Uncover top tips for selecting the perfect Mini Cooper Convertible that matches your style and needs; explore more inside!

Fuel efficiency meets style; discover which of the top 5 Mini Cooper variants best suits your lifestyle and keeps curiosity piqued.

Explore our top 10 family-friendly Mini Cooper models, perfect for balancing style with practicality—find out which one suits your family best!

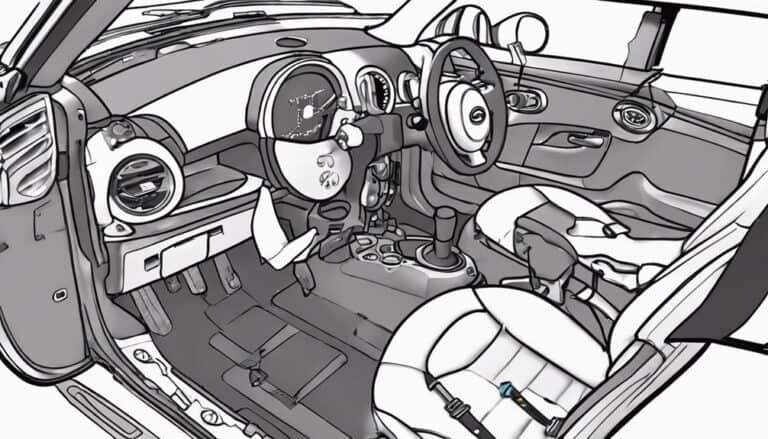

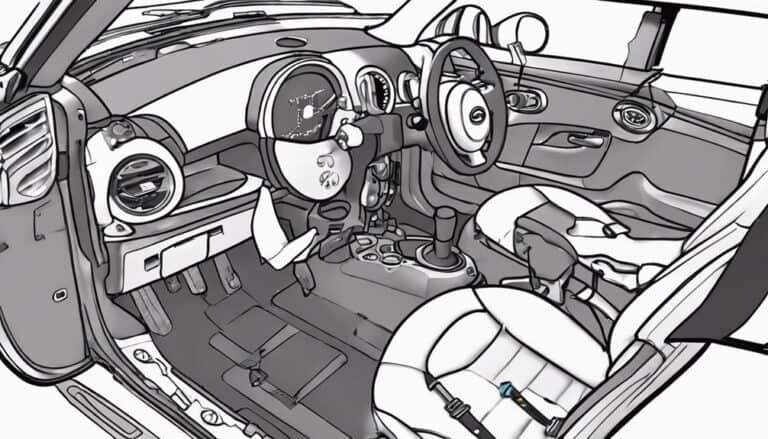

Discover how to expertly remove the footwell module on a Mini Cooper, ensuring a smooth process for...

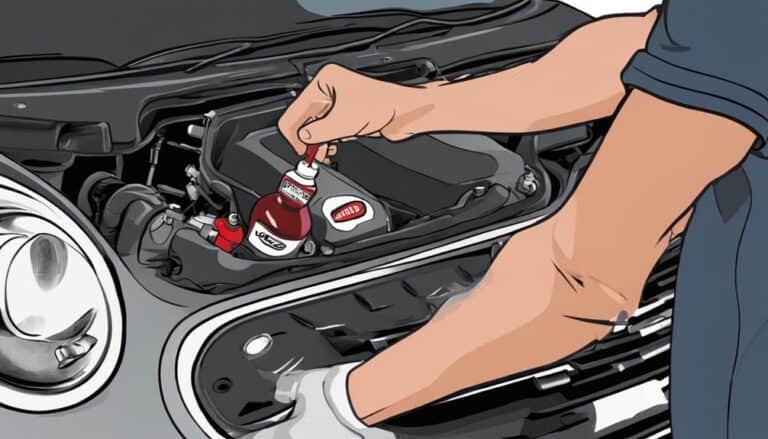

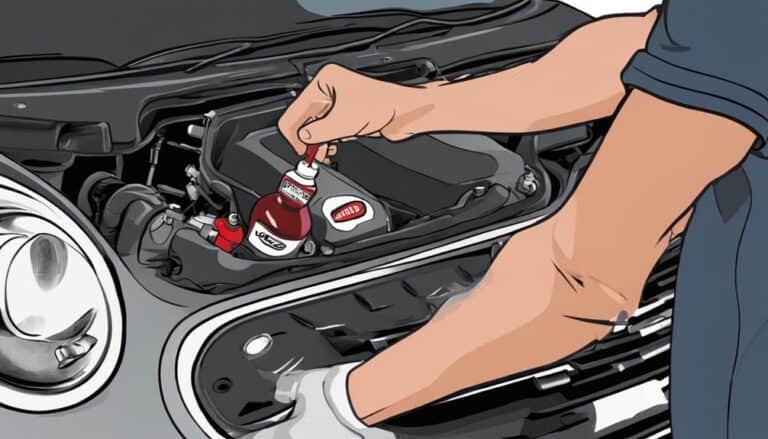

Uncover the ideal transmission fluid for a 2005 Mini Cooper and why choosing correctly is crucial for its performance—read on to find out.

Know the truth about Mini Cooper's reliability - costs, common problems, and maintenance tips await your discovery.