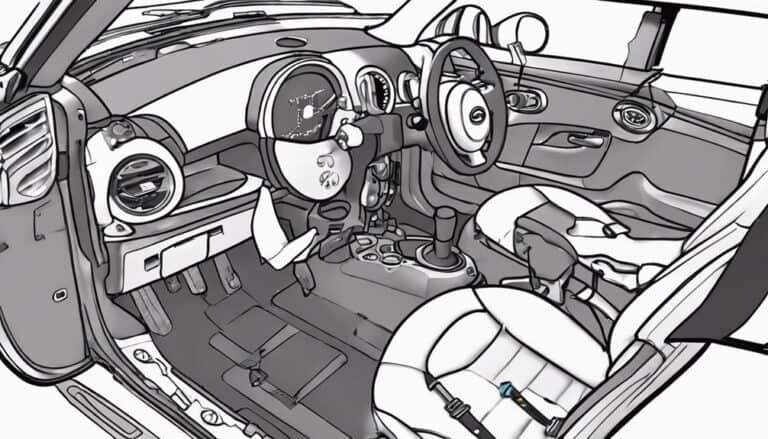

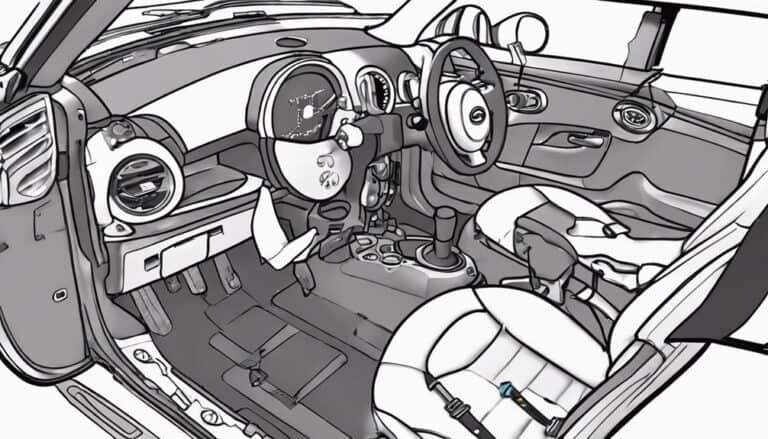

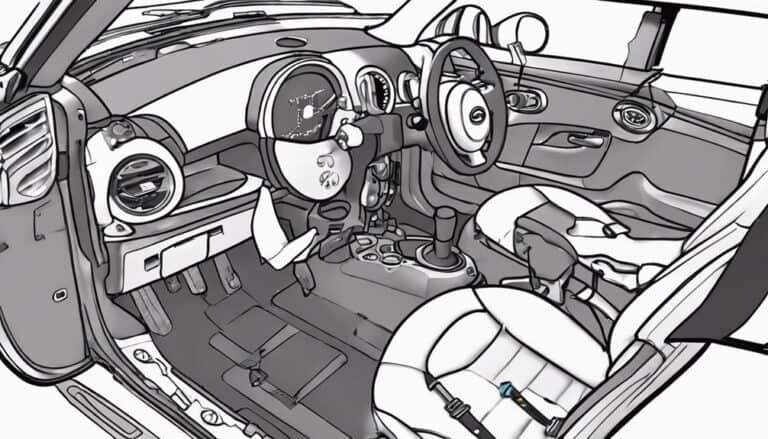

Discover how to expertly remove the footwell module on a Mini Cooper, ensuring a smooth process for...

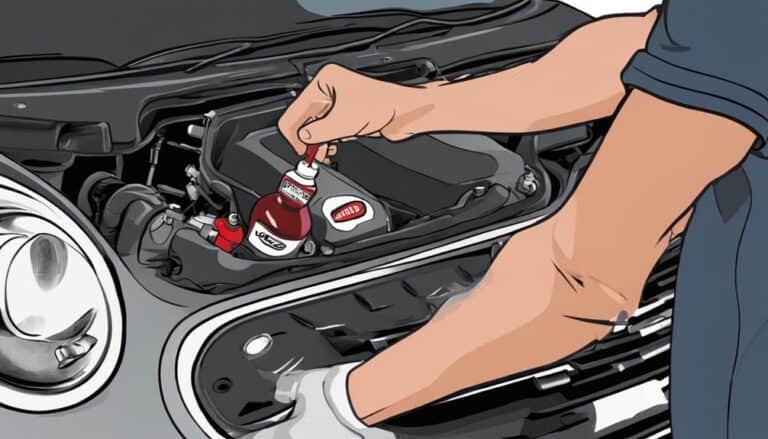

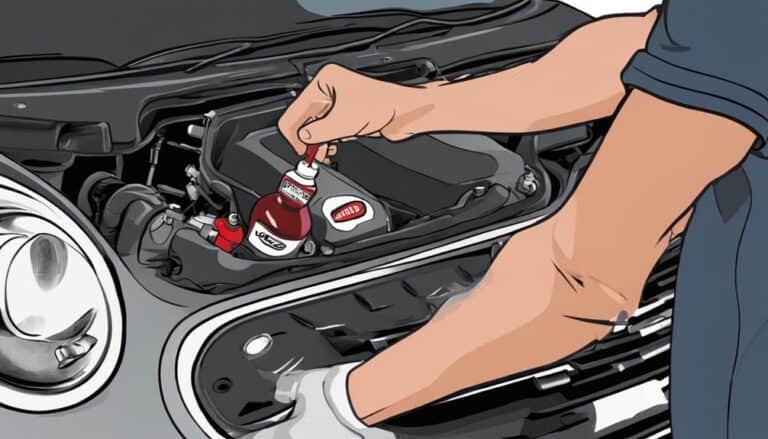

Uncover the ideal transmission fluid for a 2005 Mini Cooper and why choosing correctly is crucial for its performance—read on to find out.

Know the truth about Mini Cooper's reliability - costs, common problems, and maintenance tips await your discovery.

A quick guide to identifying when your Mini Cooper requires servicing, from dashboard alerts to unusual noises—discover what these signs mean.

This light signals a crucial warning about your Mini Cooper's brakes, uncover what it means and how to respond...

Identify the hidden gateway to your Mini Cooper's secrets by locating the elusive OBD port; uncover how and where with our guide.

Curious about locating the OBD port in your Mini Cooper? Discover the easy steps to find it and why it's crucial for diagnostics.

Get the lowdown on the 2008 Mini Cooper models, distinguishing between the base Hatchback and the turbocharged S for a thrilling ride.

Identify how many brake sensors your MINI Cooper has and learn why this knowledge is crucial for your vehicle's safety and performance.